Accept USDT: Tether Payment Gateway for Businesses

USDT has become the most practical crypto for online payments. This article breaks down how Tether transactions work, the integration methods available, why merchants adopt it, and how Scrile Connect can build a custom USDT payment gateway tailored to any business model.

accept usdt

More companies are starting to accept USDT, and the shift isn’t happening quietly. Stablecoins have moved from a niche experiment to a real day-to-day payment tool. USDT sits at the center of that change. With a market cap above $110 billion and trading volumes that regularly outpace Bitcoin, it has become the default currency for people who want the speed of crypto without the volatility.

For businesses, that stability solves several headaches. Settlements land quickly. Fees stay low. Customers from different countries don’t get stuck in currency-conversion loops. A payment sent from a phone in São Paulo or Manila reaches a merchant just as easily as a local bank transfer. That kind of predictability is hard to find in traditional systems.

The missing piece for many companies is the gateway itself — the part that turns a website into a working crypto checkout. Modern USDT gateways can read transactions on-chain, confirm payments, update orders, and sync everything with the backend so the process feels as smooth as any card payment.

This article walks through the essentials: what USDT actually is, how different payment setups work, where the real advantages show up, and what to watch out for before integrating. In the final section, we’ll look at how Scrile Connect can build a custom USDT payment flow that fits a business instead of forcing it into preset boxes.

What Is USDT and Why Businesses Accept Tether

USDT is a stablecoin designed to behave like a digital version of the US dollar. It’s issued by Tether Limited, and each token is meant to stay close to $1 through a mix of reserves, market mechanisms, and constant liquidity on major exchanges. People often search for whats USDT payment when they want a simple explanation, and the short version is this: it’s crypto that doesn’t swing wildly in price. For everyday commerce, that makes a world of difference. Nobody wants to charge $50 for a product only to discover the coin they received dropped five percent an hour later.

Its stability is a big reason USDT has become the most traded cryptocurrency on the planet. On many days, the 24-hour volume of USDT is higher than Bitcoin and Ethereum combined. Traders use it as a safe stopover between assets, and regular users rely on it as a digital dollar that moves instantly. Businesses pay attention to that kind of liquidity because it means customers can pay without friction.

Companies accept USDT for reasons that are far more practical than promotional. It settles fast. Fees stay low. Cross-border transfers don’t require a maze of correspondent banks. A USDT payment from a customer in Chile or Nigeria arrives just as easily as one from a buyer in the U.S. That predictability gives online businesses an edge, especially when their audience spans multiple currencies and countries.

Compared to traditional banking, USDT avoids delays, weekend roadblocks, and chargebacks. This is why SaaS platforms, e-commerce stores, membership sites, digital goods sellers, marketplaces, and global creators increasingly add Tether to their payment stack. For many of them, card declines, frozen international transactions, and slow settlement times create real revenue losses. USDT helps plug those gaps.

It comes in different network formats

- TRC-20 USDT on the Tron network is the cheapest option, often costing less than one dollar per transfer.

- ERC-20 USDT on Ethereum is more expensive but widely supported.

- Omni USDT is older and rarely used today.

These options let businesses choose the balance of cost and compatibility they need. Combined, they remove friction from global sales and make cross-border payments feel closer to instant messaging than finance.

Reasons merchants find USDT appealing:

- stable pricing that doesn’t derail revenue planning

- global availability without currency conversions

- lower fees than international wire transfers

- compatibility with most modern wallets and exchanges

How USDT Payments Work: Gateways and Integration Methods

Accepting crypto on a website sounds simple, but a real USDT payment setup needs more than a wallet address pasted on a checkout page. Businesses need tools that can detect incoming transfers, confirm them on-chain, update orders, and handle refunds or disputes without relying on manual checks. That’s where different integration methods come in, each with its own level of automation and control.

Crypto Payment Gateways

Platforms like B2BinPay or BitPay handle the heavy lifting. They generate addresses, watch the blockchain for confirmations, and push status updates back to your system. These gateways work well for brands that want to accept USDT with minimal development.

Advantages:

- automatic order updates and notifications

- built-in risk and compliance tools

Wallet-to-Wallet Transfers

This is the simplest version of what is USDT payment method in practice. The business provides a wallet address, and the customer sends funds.

Advantages:

- fast to set up

- no third-party fees beyond network costs

Limitations: no automation, harder refund flow, no dashboards.

Exchange Merchant Tools

Binance Pay, Bitget tools, and similar systems let customers pay directly from their exchange accounts. They usually include dispute handling and verification.

Advantages:

- high trust for customers

- smooth mobile payments

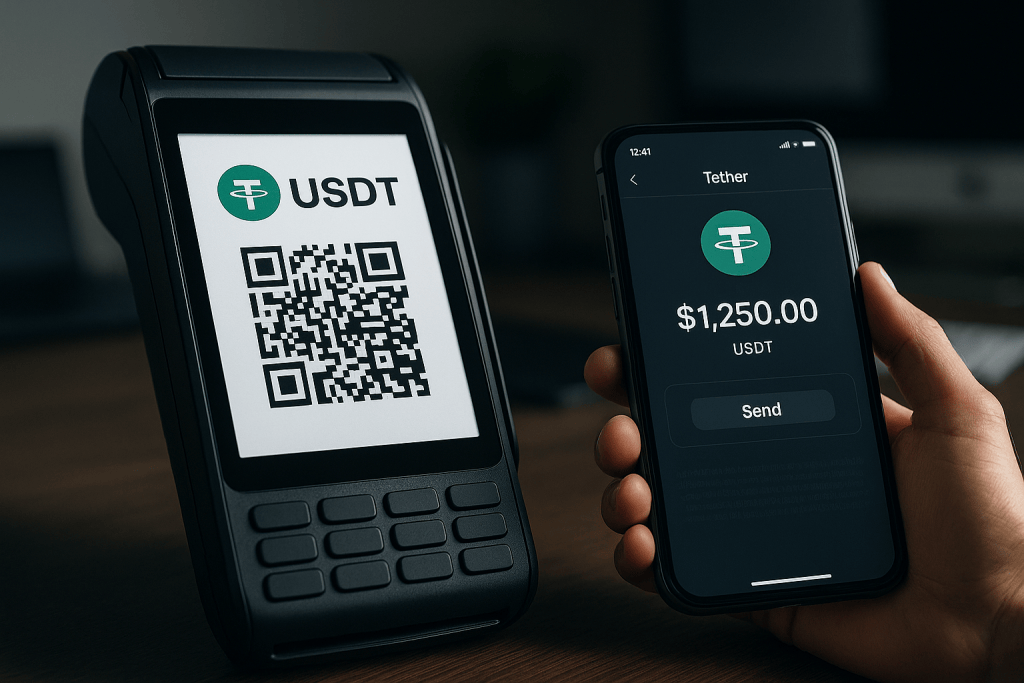

QR Code Payments

Useful for retail or services that need in-person confirmation. QR codes encode network and exact amounts to avoid mistakes.

Advantages:

- low error rate

- easy for international buyers

API-First Connections

Ideal for SaaS, marketplaces, or platforms that need complete control over how payments behave.

Advantages:

- fully customizable flows

- can connect with internal CRMs or subscription logic

CMS Plugins

WooCommerce, Shopify, and other systems support crypto through third-party processors.

Advantages:

- simple installation

- good for small stores

TRC-20 keeps fees low, ERC-20 offers broad compatibility, and older versions like Omni introduce potential compatibility issues. Choosing the right network can cut payment costs dramatically and reduce failed transactions.

USDT Payment Integration Methods Compared

| Integration Method | Automation Level | Best Use Cases | Pros | Cons |

| Crypto Payment Gateway (B2BinPay, BitPay) | High | E-commerce, SaaS, marketplaces | Automatic confirmations, fraud tools, dashboards | Gateway fees, limited customization |

| Wallet-to-Wallet Transfer | Low | Freelancers, small merchants | Zero processor fees, fast setup | No automation, manual confirmations |

| Exchange Merchant Tools (Binance Pay, Bitget Pay) | Medium | International sellers, mobile-first audiences | Trusted by users, smooth app payments | Users must have accounts on the exchange |

| QR Code USDT Payments | Medium | Retail, events, mixed online/offline payments | Simple for customers, reduces errors | Not ideal for recurring billing |

| API-First Custom Integration | Very High | SaaS, platforms, subscription systems | Fully customizable, connects to CRM or internal tools | Requires development resources |

| CMS Plugins (WooCommerce, Shopify through crypto processors) | Medium | Small/medium online stores | Easy installation, familiar admin panel | Depends on third-party processors |

Benefits for International Payments

Global payments often fall apart for reasons that have nothing to do with the buyer’s intent. Banks add currency conversion steps, transfers take days, and some regions simply refuse certain cards. This is where many businesses decide to accept USDT, because stablecoin transfers skip most of those barriers and behave more like instant messages than traditional banking.

USDT helps international sellers by solving a few real problems:

- Transfers settle fast, even during weekends, so customers don’t abandon purchases waiting for payment confirmation.

- Fees stay low, especially on TRC-20, where sending money often costs less than a dollar.

- Region blocks disappear, allowing buyers from Asia, Africa, or Latin America to pay without worrying about local card restrictions.

- No chargebacks, which is a major relief for digital sellers who deal with fraud or forced refunds.

You can see the difference in everyday scenarios:

- A freelancer in Southeast Asia completes a job and receives USD-value funds instantly, without conversion losses.

- A subscription site stops losing renewals to expired or blocked cards.

- A digital marketplace no longer spends hours disputing chargebacks.

In short, accepting stablecoins reduces the distance between buyer and seller. It removes the wait, the uncertainty, and the bank-imposed obstacles that slow global commerce. For companies handling international traffic, USDT turns cross-border payments into something far closer to a local transaction.

Restrictions and Security: What To Know Before You Integrate

Before a business decides to accept USDT, it needs a clear picture of the risks involved. Stablecoin payments move fast and skip the usual banking barriers, but that speed comes with responsibilities. Companies that ask how to pay with Tether usually learn quickly that crypto payments behave differently from traditional money, and mistakes are harder to reverse.

One of the biggest considerations is custody. Holding private keys means taking full responsibility for wallet security. Hot wallets stay online and are convenient, but they can be targeted if not protected properly. Cold wallets reduce exposure but require stricter operational routines. Both options can work, but they require thoughtful planning.

Regulation is another factor. Some countries treat stablecoins like digital assets, others see them as financial instruments, and a few still have no clear rules at all. Merchants may need KYC or AML checks depending on their location and industry. This becomes even more important for platforms serving global audiences.

There are also network-specific risks. Sending USDT on the wrong chain — for example, TRC-20 to an ERC-20 address — can permanently lock funds. Network congestion can slow confirmations during peak activity. And although Tether maintains a large reserve and publishes reports, stablecoin transparency is still an ongoing debate in the crypto community.

Businesses reduce these risks by using tools such as:

- multi-signature wallets for shared control

- custodial partners that handle storage and compliance

- transaction whitelists that block suspicious addresses

- automated chain detection to prevent mis-sent funds

Crypto payments are powerful, but they require preparation. Understanding these limits helps companies integrate USDT safely and confidently.

Accept USDT on Your Website With Scrile Connect

By this point, it is clear why so many global merchants look into stablecoin payments. After seeing who accepts USDT already — creators, marketplaces, SaaS platforms, subscription sites — many businesses want the same flexibility but without relying on generic gateways. That is the moment they start evaluating how to build something of their own, something that fits their workflow instead of forcing them into someone else’s. This is where Scrile Connect comes in.

Scrile Connect does not offer a template or a pre-made payment plugin. It works as a custom development service, meaning every part of the payment flow can be shaped around your brand, your rules, and your audience. If a company wants to accept Tether on its website, handle USDT subscriptions, or mix crypto and fiat checkout options, the system can be built exactly for that use case.

A custom setup can include elements such as:

- branded, white-label checkout pages with pricing shown in fiat or stablecoins

- subscription payments, paywalls, memberships, and one-click purchases

- smart on-chain verification for TRC-20 and ERC-20 transfers

- custodial or non-custodial wallet options

- KYC and AML modules if compliance matters in your region

- fraud screening that adapts to your business model

Beyond processing payments, Scrile Connect also builds the supporting infrastructure:

- analytics panels showing behavior, retention, and revenue patterns

- API extensions that tie payments to CRMs, dashboards, or marketplace logic

- full data ownership and the ability to adjust flows as your product evolves

With this approach, any business can accept USDT without third-party limits. Scrile Connect delivers a payment architecture that stays flexible, secure, and aligned with long-term growth instead of short-term convenience.

Conclusion

USDT earned its place in global commerce because it behaves like money should: stable in value, fast to move, and accessible across borders without complicated banking rules. For businesses, adding crypto payments is not a trend play, it is a practical way to reach customers who get blocked by cards, conversion fees, or region-based restrictions.

The only real hurdles are security and compliance, and both can be handled with the right system in place. That is where Scrile Connect becomes useful. Instead of forcing brands into preset gateways, it builds custom USDT payment flows designed around the business itself — including checkout logic, wallet handling, compliance modules, and analytics.

If your company is considering crypto payments and wants full control over how the system works, you can contact the Scrile Connect team to explore a tailor-made solution.

FAQ

How to accept USDT payment?

Businesses usually start by creating a verified merchant account with a crypto gateway or exchange-based payment tool. From there, they can integrate USDT checkout through APIs, plugins, or custom payment modules. The system detects on-chain confirmations, updates orders, and routes payments to the company’s wallet.

What platform accepts USDT?

Most major exchanges support USDT across multiple networks. Platforms such as PrimeXBT, Bybit, Binance, and KuCoin offer trading, custodial or self-custody wallets, and tools that help users store, send, or convert their Tether balance. Their wide asset support and liquidity make USDT easy to use for payments or transfers.

Can banks accept USDT?

Traditional banks cannot receive USDT directly, since they operate on fiat rails. To move stablecoins into a bank account, users need a third-party service or exchange that converts crypto to fiat before depositing it. These platforms connect a user’s wallet to their bank account and process the transfer through standard withdrawal methods.