Crypto Invoicing: Generate Bitcoin & Blockchain Invoices

Learn how crypto invoicing works and how to generate Bitcoin or stablecoin payment requests for clients worldwide. Faster settlement, lower fees, and fully traceable blockchain receipts — all explained in simple steps.

Crypto Invoicing

Let’s be honest. Getting paid across borders is often a small nightmare. Anyone who’s freelanced or worked with overseas clients knows the dance — “Wire transfer is coming,” “Bank says wait three more days,” “The fee was higher than expected,” and your payment just… sits somewhere. No one can tell you where exactly.

At some point you start thinking, there has to be another way.

That’s where crypto invoicing enters the picture. It’s basically a regular invoice, the same breakdown of what was delivered and what’s owed, but the payment happens in Bitcoin, USDT, ETH, or another crypto your client is comfortable with. The money moves faster. You don’t wait on banks. There are no weird currency conversions where $200 just disappears for no reason.

People aren’t choosing crypto invoicing because it’s trendy. They’re choosing it because it works. It’s straightforward. It clears. It shows up.

Alright — let’s walk through how to actually use it.

Why Crypto Invoicing Exists

Businesses didn’t adopt crypto invoicing because it sounded futuristic. They adopted it because the old way of getting paid across borders started getting in the way of work. When a designer in one country works with a startup in another, traditional banking often moves slower than the project itself.

Before we talk benefits, the idea is simple: a crypto invoice is just a payment request tied to a wallet address or QR code. The client sees the requested amount, sends the payment, and the transaction becomes verifiable on the blockchain. No negotiation with banks, no multi-day waiting stages, no unclear “intermediate processor” fees.

Here’s what this solves in practice:

- Delays caused by international bank transfers

- High currency conversion fees

- Unpredictable exchange rates during slow settlement

- Payment blocks when regions or banks don’t cooperate

- The need to “prove” a transfer happened

And here’s what becomes easier when using a blockchain invoice:

- Settlement usually happens in minutes, not days

- Fees are often lower and more transparent

- Payments work across borders without special permissions

- You get a clear payment bitcoin transaction receipt on-chain

- Stablecoins like USDT/USDC reduce volatility while keeping dollar value

To make this feel real instead of abstract:

A freelance illustrator in Argentina bills a game studio in Germany using a bitcoin invoice. The studio scans a QR code, pays, and the illustrator sees confirmation within minutes. No email threads asking “Did the wire arrive?” No searching for a bitcoin transfer receipt screenshot. The blockchain itself is the receipt — timestamped, public, final.

What Exactly Is a Crypto Invoice?

When we talk about crypto invoicing, we’re not describing a new kind of financial document — we’re describing a new payment rail. The invoice itself looks familiar. The way the money moves is what changes.

Core Elements

A crypto invoice includes the same basic details as any standard invoice: the client name, the amount owed, a short description of the work, and a due date. The difference comes in the payment field.

Instead of bank coordinates or IBAN numbers, the invoice lists:

- A crypto wallet address (e.g., BTC, ETH, USDT)

- Or a scannable QR code that fills the payment details automatically

- Sometimes a dynamic link that updates exchange rates in real time

Nothing else about the billing document needs to feel unusual. The client still receives a PDF, a hosted invoice page, or a formatted email. The only thing that shifts is where the payment goes.

Many invoicing tools now also display the equivalent amount in USD/EUR next to the crypto amount. That keeps the pricing conversation clear, even if the client pays with Bitcoin, USDT, or another token. The invoice works in familiar numbers; the payment happens in digital currency.

How It Differs from Traditional Invoices

A traditional invoice relies on banks or processors to confirm payment. You send it. You wait. The confirmation depends on internal systems and business hours.

A blockchain invoice settles on-chain. That means the confirmation doesn’t come from a bank. It comes from the blockchain itself. Once a transaction appears in the ledger with enough confirmations, that’s your proof of payment — timestamped, verifiable, independent from any institution.

This also means the “receipt” is built-in. The blockchain functions as the public payment record, removing the need for emailed screenshots or “please confirm you received it” messages.

If price volatility is a concern, many businesses use stablecoins (USDT, USDC) to keep amounts consistent. The invoice shows a fiat value; the stablecoin simply represents it on-chain.

The result is something surprisingly practical:

An invoice that feels normal — and a payment method that moves fast, works globally, and doesn’t rely on bank approval at all.

Supported Currencies & Wallet Basics

When people start working with crypto invoicing, one of the first questions is, “What exactly am I getting paid in?” The answer is flexible. You can issue a crypto invoice in Bitcoin, Ethereum, or in stablecoins like USDT or USDC — whichever matches how you want to manage value.

Some freelancers prefer BTC as a long-term asset. Others choose stablecoins so the amount they receive stays close to the originally agreed price. The invoice itself usually shows the price in a familiar currency (USD, EUR) and simply converts the payment field into a crypto amount at the moment of sending. So the business conversation stays the same — the transfer method changes.

Where the payment lands depends on your wallet setup. There are three broad categories:

- A self-custody wallet (you control the keys)

- A custodial wallet from an exchange

- Or a hosted account from a payment service provider

Each works. The difference is who controls access and how much responsibility you take for security.

Custodial vs Non-custodial Wallets

Self-custody wallets give you full ownership. You keep your private keys, and nobody can freeze or reroute your funds. This fits small agencies, developers, and digital artists who want financial independence. The responsibility here is learning to back up seed phrases properly and storing them offline.

A custodial wallet is more like a bank login. You use an email and password, the provider stores your keys, and recovery is easy. This setup works well for accountants or business managers who care more about convenience than sovereignty. They can generate a bitcoin invoice today and have accounting staff view balances with familiar dashboards.

Payment processors fall in between. They let you accept crypto and send it wherever you want later. Many businesses choose this path because it reduces operational friction.

No matter which wallet type is used, the workflow is the same: the invoice lists a wallet address or QR code, the client pays, and the funds appear quickly — with a verifiable on-chain confirmation that functions as your blockchain invoice record.

The key is choosing the wallet setup that matches how comfortable you are managing your own money directly.

How to Generate a Crypto Invoice Step-by-Step

When you strip away the jargon, making a bitcoin invoice isn’t complicated. It works almost like issuing a regular invoice — you just replace the bank details with a crypto wallet address or a scannable QR code.

Here’s a clean, practical workflow you can follow right away:

1. Choose the Currency

Decide what you want to receive: BTC for long-term value, ETH if your ecosystem is Ethereum-based, or USDT/USDC if you want stable pricing that won’t fluctuate after payment is made.

2. Prepare Your Wallet Address

Open your wallet app and generate a receiving address. If you’ll work with the same clients regularly, you can even create a reusable payment link so you don’t have to copy/paste new addresses every time.

3. Draft the Invoice Details

Name, client info, project or service description, amount, due date. This part looks exactly like a normal invoice. Only one field changes — the “payment to” field now contains your wallet address.

4. Include Payment Instructions

Add a simple line such as: “Send payment to this wallet address” or display a QR code that the client can scan.

This is where some people use a bitcoin receipt generator or invoicing tool that formats everything neatly.

5. Send the Invoice

You can attach it to an email, send it via messaging platform, or host it inside your website client portal.

6. Payment & Verification

The client transfers the crypto. You confirm the transaction by checking the blockchain explorer — the on-chain confirmation itself acts as your payment bitcoin transaction receipt and can be archived. If needed, export a bitcoin transfer receipt for accounting or tax reporting.

Once the network confirms, you’re paid — clean, transparent, verifiable.

Advantages of crypto invoicing

Rather than following trends, offering cryptocurrency billing options is about eliminating frictions associated with moving funds. If international transactions are involved, simple transfers can take days to process. These transfers can involve banks but are usually done through multiple banks. Such transactions can attract charges that parties would not expect. Crypto billing eliminates waiting rooms and clearance lines because funds will be moving straight from customers to businesses.

For many freelancers, small studios, and online agencies, this speed changes everything. Work gets delivered and compensated in the same rhythm. Clients in different continents don’t need permission from their bank to pay you. You don’t have to explain why a transfer is “still processing.” The transaction simply completes.

Another advantage is flexibility with currencies. Stablecoins allow invoicing at a predictable value, while assets like BTC or ETH can be held long-term if desired. It’s your call, not the bank’s.

Benefits at a glance:

- Faster payment settlement across borders

- Lower or more predictable transaction fees

- Works even when traditional banking access is limited

- Can align with both stable pricing or long-term asset holding

- Easy tracking of payments through public transaction records

Less waiting. Less uncertainty. More control over your own revenue flow.

Comparison Table

| Feature | Bank Transfer | Crypto Invoice |

| Settlement Time | 1–5 days | Minutes–hours |

| International Fees | High | Low–Medium |

| Transparency | Low (opaque banking routes) | Full on-chain visibility |

| Reversal Risk | Chargebacks or holds possible | Irreversible once confirmed |

| Control | Bank-dependent | Wallet owner has full control |

Risks, Regulation & Accounting

Using crypto invoicing doesn’t remove the responsibility of tracking income. The payment method changes, but the business obligations stay. Most countries treat revenue the same regardless of whether it arrives in dollars, euros, bitcoin, or stablecoins. You still log the income, store the invoice, and report the value in your local currency at the moment of payment.

To avoid price swings, a lot of businesses choose to settle and invoice in stablecoins like USDT or USDC. The value stays close to a dollar, which keeps accounting straightforward. You send the invoice, receive the payment, and enter the amount into your books at the exchange rate visible that day. No guessing and no watching charts to figure out what the payment is “worth.”

If you hold BTC or ETH long-term, you may also create separate records — one for the income, one for any future gains or losses if you later convert or spend it. Some businesses keep a simple spreadsheet, others connect their wallet to accounting tools that automatically record transactions.

None of this requires complex legal language. It just requires consistency: store your invoices, note the payment value when received, and keep a clear record.

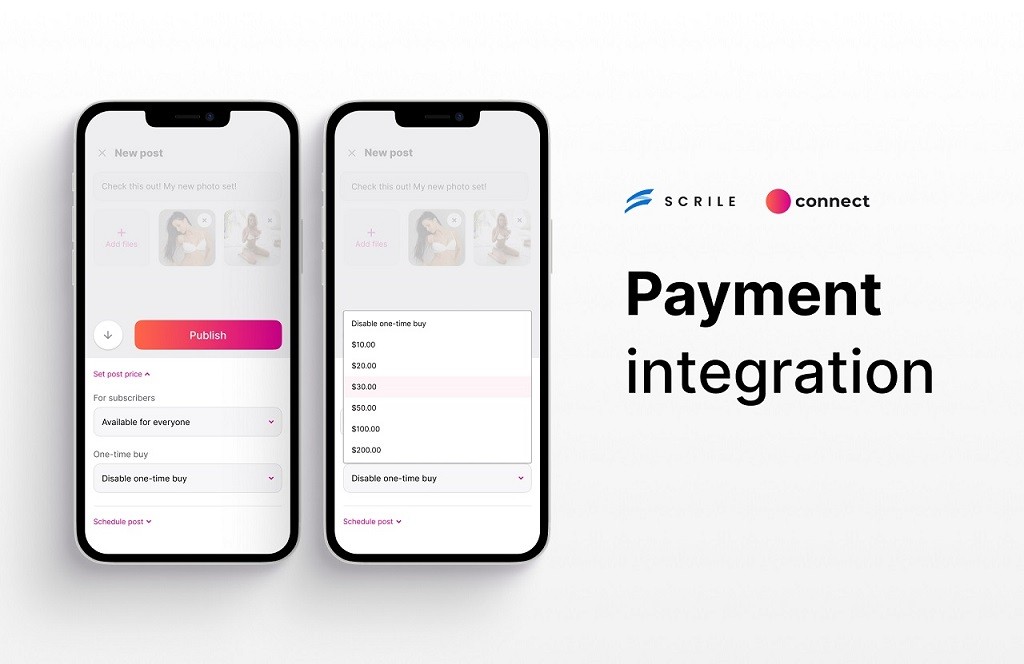

Implement Crypto Invoicing in Your Website with Scrile Connect

Adding crypto invoicing to your workflow shouldn’t mean outsourcing your entire payment system to a third-party gateway you don’t control. Scrile Connect approaches this differently. Instead of giving you “yet another platform to log into,” it integrates directly into the website or service you already operate.

Scrile Connect is a development service — not a plug-and-play checkout tool. You’re not adapting your business to someone else’s structure. The system is shaped around how you work. That includes choosing which currencies to accept (BTC, ETH, USDT, or others), defining how invoices are generated, and deciding what the client sees when they receive a payment request.

You also maintain your brand identity throughout the experience. No external logos, no redirects to outside payment portals, no broken trust because the payment page suddenly feels unfamiliar.

This approach works well for:

- Freelancers who invoice clients across borders

- Creative studios and agencies with repeat retainers

- SaaS platforms that need multi-user invoicing logic

- Marketplaces where sellers receive earnings in crypto

- Service businesses that want faster settlement and less banking hassle

Another important detail: you maintain ownership. Funds aren’t held by an intermediary service that decides when you can withdraw. You decide where payments are directed and when they’re settled. You keep control of your ledger, your customers, and your workflow.

Scrile Connect doesn’t try to replace your business model — it gives it the infrastructure to operate smoothly in a global economy where clients don’t all use the same banking system. If your work already spans countries, time zones, and currencies, then your payment system should too.

Conclusion

Working with clients across borders becomes simpler when payments don’t have to pass through a maze of banks and delays. Crypto invoicing gives freelancers, agencies, and online service providers more control over how money arrives and when it clears. The key is to use it thoughtfully: stablecoins for predictability, clear records for accounting, and tools that fit your workflow.

If you want a system that integrates directly into your own site, reach out to Scrile Connect to integrate crypto payments into your business on your terms.

FAQ

What is crypto invoicing?

It’s sending a standard invoice, but with a crypto wallet address instead of bank details. The payment shows on the blockchain as confirmation.

How to make a crypto invoice?

Create your invoice normally, list the price, and include your BTC/USDT wallet address. The client pays to that address, and you record the income in your usual currency.

What is a Bitcoin invoice?

It’s an invoice that requests payment in Bitcoin, usually providing a BTC receiving address or QR code along with the exact amount to send.