How Is Crypto Taxed? Key Rules in 2026

You don’t need to be overwhelmed by crypto tax issues in 2026. Digital assets are generally treated as “property” by most governments, and as such, selling, trading, and using the cryptocurrency may create taxable events for the user. Understanding the basic principles of capital gains and income taxation will help keep you compliant and avoid unpleasant surprises this tax season.

how is crypto taxed

Understanding Cryptocurrency Taxes in 2026

When trading or earning digital assets, you’ve likely thought to yourself, “How is crypto taxed today?” And you aren’t alone. As digital asset markets grow, there is an increasing amount of pressure from governments to provide clarity on how they are treated for taxation. Therefore, the fundamentals of cryptocurrency taxes will soon become vital for every entrepreneur, creator, and investor to understand.

It may be difficult to comprehend this change in how most tax agencies view crypto as property rather than currency. However, once you’ve taken time to sort out your coins into their respective categories, you can see that the outline of taxes on crypto is quite simple. Each time you sell a coin, trade a coin, or purchase something with a coin, you will most likely create a taxable event due to the property classification of your crypto. Therefore, it is vital to stay on top of your record keeping and tax obligations if you want to avoid any tax complications in the future.

General Rules: How Is Crypto Taxed in Most Countries?

If you zoom out and look at the global picture, you’ll notice something interesting. Most countries follow the same basic logic when deciding how is crypto taxed, even if the details vary.

Generally speaking, the vast majority of crypto traded throughout the world today is treated as property and taxed just like the many forms of stock. That means when you sell, trade, or convert your tokens, you may owe a tax on crypto gains. In most cases, short-term gains will be taxed at a higher tax rate than long-term gains. This is intended to encourage investors to hold their currencies rather than day trade them during bubble phases of the market.

The IRS regards cryptocurrency earned from staking, mining, freelancing, and bonuses as standard, taxable income. Therefore, a common question is, “Is bitcoin taxed if I receive it as a form of payment?” In most situations, yes. When you receive BTC for payment, the fair market value of the asset at the time of receipt is considered “taxable income.” If you later sell your BTC for more than you paid for it, you will pay taxes again on that profit.

The answer to the question, “Exactly how is Bitcoin taxed compared to the rest?” is generally, none. Bitcoin and other digital assets are treated under the same laws regarding capital gains and income. What varies with Bitcoin and other digital assets is the difficulty with which they are reported.

All of this can feel like juggling, but the framework gets clearer once you understand these two categories. Capital gains. Income. Most global tax systems start here. And once you grasp that, navigating crypto taxation becomes far less intimidating.

Taxes on Trading, Staking, Mining & Donations

Taxes on Crypto Gains

When people first try to figure out how is crypto taxed, this is usually the section that causes the most confusion. Trading, earning, gifting—it all feels like one big digital blur. But from a tax perspective, each activity falls into its own category with its own rules. Once you see the distinctions, the whole picture becomes much easier to manage.

Traders must report their asset swap gains. The government wants to know whether you made money on that move. If you bought ETH at $1,500 and swapped it for SOL when ETH was worth $2,000, that $500 difference becomes taxes on crypto gains.

If you’ve been wondering, “Is bitcoin taxed if I earn it through mining or as staking rewards?” the answer is yes in most countries. The moment you receive your coins is when they have a fair market value, which is taxable as income. Then when you sell them, you will calculate capital gains on top of that. This is usually a surprise to new investors, but it applies everywhere.

Gifts and Donations

Another aspect of crypto is that gifts and donations allow you to give gifts or make donations to either a charity or an individual. A donation to charity can often give you a charitable deduction. And you most likely will not be subject to taxes on the amount donated by you in many cases. However, when it comes to giving a crypto gift to a family member or friend, the IRS has certain reporting obligations for large-value gifts. In that case, you still need to track the original cost basis. The point is that someday the recipient may need to calculate their own tax on crypto gains when they dispose of it.

If you’re still unsure how is Bitcoin taxed in all of this, don’t worry, Bitcoin usually follows the same rules. No special treatment, no special exemptions. Whether you’re trading BTC, earning it, or giving it away, the same income-and-gains framework applies. Understanding these basics sets a strong foundation for staying compliant and avoiding unpleasant surprises during tax season.

How Is Bitcoin Taxed Compared to Other Crypto?

Most people believe bitcoin is in a class by itself because it was the first major digital currency and still constitutes a significant portion of the market. But when you break down how is Bitcoin taxed, you’ll find that most governments treat it the same way they treat other cryptocurrencies. Its role in the market will influence how users treat it, which also plays a role in the taxation of it in practical ways. Most long-term holders will view Bitcoin as digital gold.

Bitcoin and Taxes

Businesses that accept bitcoin as payment experience a higher frequency of taxable events. Each time a customer pays with bitcoin, the business must record the fair market value of the transaction at the time of the transaction. In addition, if the business later converts to fiat currency or another cryptocurrency, the business must calculate any capital gains. This process is achievable with proper tools. But it requires an added layer of accounting for any business accepting bitcoin compared to traditional payments.

Crypto Taxation Around the World

Crypto may belong to the world, but the laws concerning taxes do not. Each country has different approaches, has its own paperwork, and has different ideas about what “fair regulation” is. Understanding how various regions view digital assets will reduce anxiety when conducting business online. This will break down how different markets have approached taxes on crypto and where you stand in 2026.

How Is Crypto Taxed in Different Countries?

| Country/region | Tax treatment of crypto | Key notes |

| United States | Crypto is treated as property. Capital gains rules apply to sales, swaps, and payments. Income from staking, mining, or crypto earned as payment is taxed as ordinary income. | Platforms now submit 1099 forms for reporting. Accurate recordkeeping is essential due to detailed IRS requirements. |

| European Union | Most countries treat crypto as property, but tax rates and rules vary widely. | Germany taxes crypto after selling for 12 months, and France uses various capital gains brackets based on the amounts invested, thus creating an investor climate in the EU that is favorable to investing in cryptocurrencies. MiCA is bringing more harmonization to how regulation is applied across Europe. |

| United Kingdom | Crypto is treated as an asset. Capital gains tax applies on sales, swaps, or spending. Staking and income from crypto are taxed as regular earnings. | HMRC requires detailed transaction records. Businesses accepting crypto must manage bookkeeping carefully, but rules are stable and well-documented. |

| Singapore | No capital gains tax for individuals. | Businesses earning or trading crypto may still be subject to income tax. Highly attractive for traders and long-term holders. |

| Japan | Crypto gains are taxed as income, often at higher rates than capital gains. | Taxation can be burdensome for traders, especially during volatile markets with rising prices. |

Emerging Crypto-Friendly Jurisdictions

Global cryptocurrency businesses can find a highly attractive home in several countries, including Malta, Portugal, and the United Arab Emirates (UAE). As for Portugal, for many years they were the only country with a zero tax on crypto gains. But recently that has now changed by adding new stipulations about what constitutes zero percent. The UAE is very attractive to businesses because of the relatively small number of business-friendly areas along with very low taxes on crypto-related activities. Start-ups, payment processors, and Decentralized Autonomous Organizations (DAOs) tend to gravitate towards areas of clear regulatory regions.

Practical Tips for Businesses and Individuals

For Individual Investors

Keep track of everything. Log everything you buy or sell, swap, or receive as rewards. While some may not think logging small purchases or sales is important, many investors find it beneficial to use apps that log transactions automatically. So you do not have to spend time recreating what has already happened. They also offer easy-to-read calculations of how much you gained, lost, or earned from the activity. So, when it comes time for taxes, you will not have to go back through a full year of history.

Watch your holding period. Holding an asset longer could result in a lower tax rate than if you had sold it short. By selling assets at a loss, you may offset part of your taxes on crypto gains and keep your liability under control.

For Businesses Accepting Crypto

Start with clean, timestamped records for each transaction. So, you know how much the crypto is worth when you receive it. And when you spend or sell the crypto, you will calculate the gain or loss based on the value at that time.

Another important factor to consider when recording your transactions is to create a company or employee internal policy to determine how you will use the crypto your business will accept. Each of these methods of accepting crypto has different tax and accounting implications. So, determine which will align with your tolerance for each risk and how you currently do business.

Minimizing Liability (Legally)

Everybody hates to pay higher taxes than necessary. However, there are many tools you can use. Deductions for transaction fees are available in many countries. And you may be able to use your losses from losing trades to reduce taxable income. If your business operates in multiple countries, you may be able to choose an appropriate business structure.

Finally, don’t forget to seek professional assistance. Even experienced crypto traders may consult with tax professionals to verify their tax returns when dealing with multiple chains, wallets, and income sources. Good tax advice can save you time, money, and stress.

Need Help Setting Up Crypto Payments?

Integrating crypto payments into a business can seem easy. Just plug in a widget and go. But there are many challenges. In addition to the excitement of speedy transactions, reaching beyond borders, and debit card-type payment options, other factors include security, volatility, compliance with governments’ laws, invoicing, and more. Many businesses turn to professional developers for these reasons, creating custom solutions for taxes and easing their customers through a simple and seamless checkout process.

When you’re ready to move from a “plug in” type of application to a full-fledged eCommerce site, hiring professional developers becomes key. They will help you create an organized and efficient site that works for your customers while taking care of the technical details of the integration process.

Custom Crypto Development by Scrile

Scrile can develop an ecosystem for your business or an online application that uses cryptocurrency payments, plus Web3-based products and services, without the hassle of traditional payment systems.

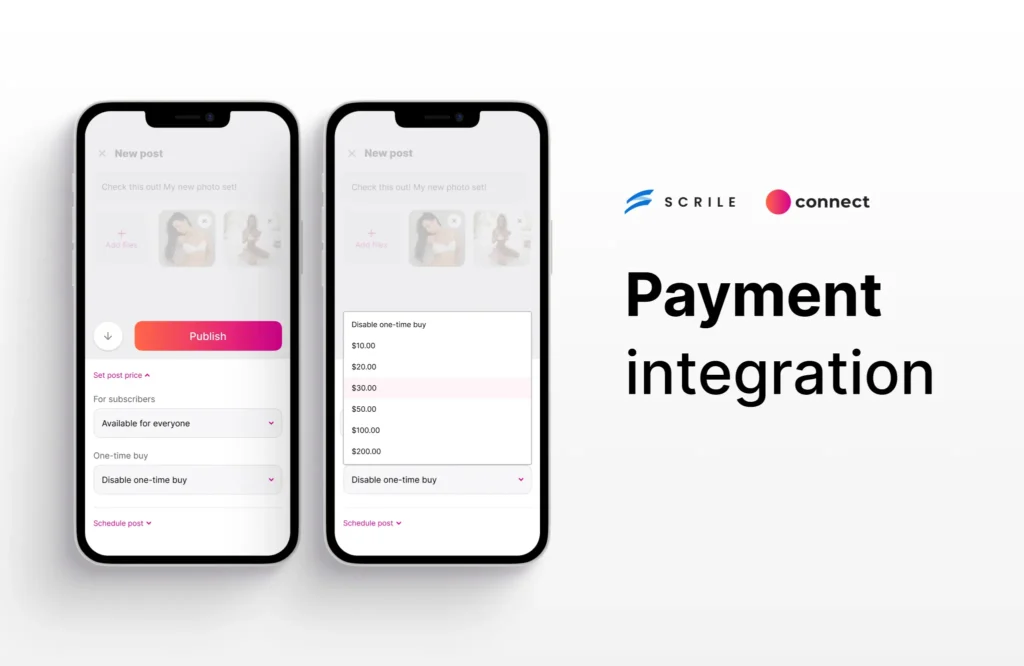

End-to-End Payment Integration

Scrile will create and install a custom cryptocurrency payment system for your business. It will include everything from integrated wallets to automated invoicing to monitoring on-chain transactions to a fast and easy checkout flow. No need to use a third-party plugin. Your payment system will be whatever you need it to be.

Compliance-Ready Architecture

Governments worldwide continue to implement stringent regulations around digital assets. And businesses must take into account how best to keep track of all their digital transactions. Scrile has created dashboards to help businesses with their recordkeeping needs by providing clear visibility into their transactions at the time of payment.

Why Businesses Choose Scrile

Scrile provides a complete support structure throughout all stages of the product life cycle. We’ve got what you need if you want to get into cryptocurrency via payments or you want to develop something different by utilizing blockchain technology. With Scrile, you will create the technical infrastructure you need to grow your business and brand. For more information, please contact our team.

FAQ

How much tax do you pay on your crypto?

The amount of taxes on cryptocurrency is based on your total income generated during the year from salary, freelancing, and all other income sources. Profits from cryptocurrency investing will generally be classified as capital gains. And taxed at capital gains tax rates based on how long you’ve held that investment. So, if you did a day trade and sold a position within one year’s time, you’d pay your ordinary tax bracket. However, if you held your investment for longer than one year, you would typically receive a lower capital gains tax rate. Keeping notes and good accounting of your crypto deals will make tax calculating easier as well as reduce the likelihood of last-minute surprises.

How do they tax you on crypto?

Under the taxation rules for cryptocurrency, there are two primary categories of income to consider. The first is income, which requires you to pay taxes on earnings from any crypto sold or exchanged after less than one year of holding. The second is long-term capital gains, which you can take advantage of once you hold your coins for more than one year.

Anytime you acquire coins through mining, staking, or other activities, that transaction creates an immediate tax liability at the moment you receive the coins based on what their fair market value was when you received the coins. By following these rules and understanding how taxes will affect your profits from trading and staking, you can maximize the amount of taxes you owe when trading or earning cryptocurrency.

Do you have to report crypto under $600?

It is true that according to current standards, you must report any taxable profit from cryptocurrency, even if it is only a small amount. Although some exchanges may not provide tax forms for transactions under a certain amount. Even “small” transactions count when calculating taxes on crypto gains. Keeping detailed records of all your cryptocurrency transactions can help ensure that you remain compliant with the tax laws in the future.