Conversational AI in Finance: Real Use Cases

Conversational AI is reshaping how banks, insurers, and fintech companies handle onboarding, support, and compliance. This article explores real-world use cases, measurable outcomes, and why custom-built conversational systems are becoming core financial infrastructure.

Talk to anyone who has tried to resolve a banking issue late at night or during a busy workday. They do not want to dig through menus or wait on hold. They want to explain the problem and get a clear answer. That simple expectation is quietly reshaping how financial services are built. Conversational AI in finance fits into this shift because it matches how people already think and speak.

Support queues keep growing, products get more complex, and teams cannot scale human operators endlessly. Conversations help close that gap. A well-designed AI assistant can handle routine questions, guide users through forms, and flag complex cases for a specialist. It does this without changing the core product or forcing customers to learn a new interface.

This article looks at how these systems work in practice, where they deliver real value, and where limits still exist, with a closer look at how Scrile AI supports building custom conversational solutions for financial services.

From Scripts to Systems: How AI Reshaped Financial Interactions

The first wave of chatbots in finance felt limited because they were. Most followed scripts built from decision trees. A user picked a topic, then another, then another. One wrong turn meant starting over or calling support. These tools reduced some load, yet they never understood intent. They matched keywords and hoped for the best.

That changed once AI systems began connecting language understanding with real operations. Modern assistants listen for meaning, not buttons. A message like “my card payment didn’t go through” can trigger a balance check, recent transaction lookup, and a follow-up question in one flow. This is where conversational ai in financial services stopped being a front-end feature and became part of the system itself.

What makes this work is the overlap of several layers. Natural language processing interprets intent. Analytics tracks context and user history. Transaction logic connects the conversation to accounts, payments, or documents. None of these pieces work alone. Together, they turn short messages into actions. A balance request pulls live data. A payment issue opens a case. A policy question retrieves the right clause instead of a generic FAQ.

Finance also treats AI differently than retail or media. Mistakes cost more. A wrong movie recommendation is annoying. A wrong transaction answer breaks trust. That is why adoption moves slower and deeper at the same time. Teams focus less on flashy features and more on reliability, audit trails, and clear escalation paths. In this environment, conversational ai for finance becomes a controlled interface, not a free-form chat toy.

Typical workflows now handled through conversation include:

- Balance and transaction status checks

- Card and payment issue reporting

- Policy or contract clarification

- Document submission and status updates

Where Conversational AI Actually Works in Banks and Fintech

Banks and fintech companies adopt conversational systems for practical reasons, not experimentation. Support queues grow faster than teams. Products become harder to explain. Customers expect instant clarity when money is involved. This is where conversational AI in banking shows real value, especially in high-volume, repeatable interactions that already follow clear rules.

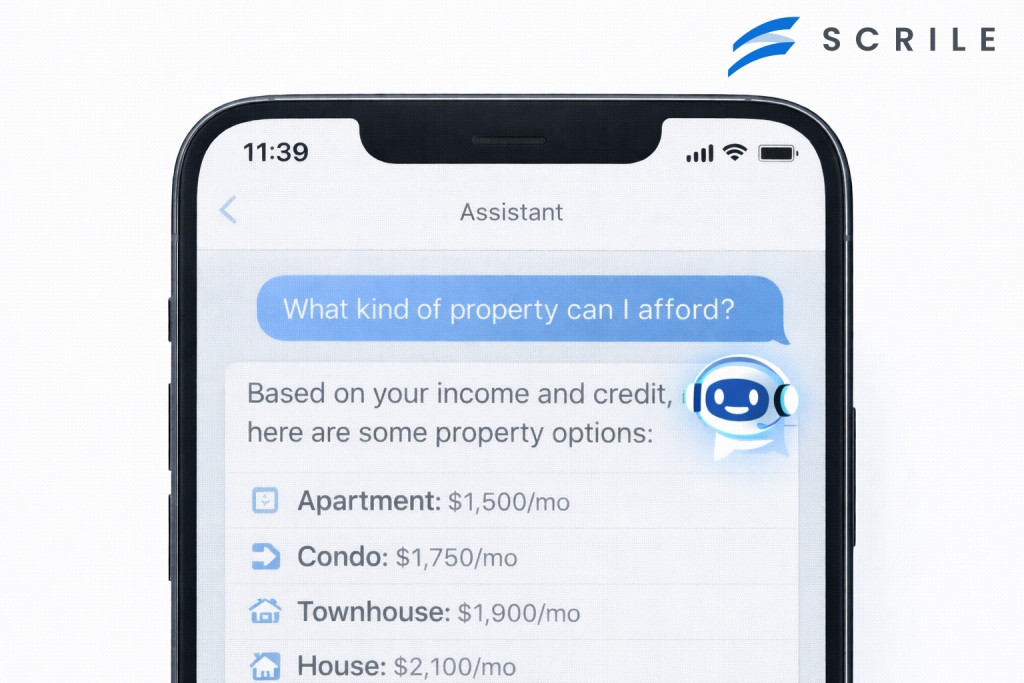

Account onboarding is a strong starting point. Many users drop out because a document is missing or a form field fails validation without explanation. A conversational interface turns these failures into short exchanges that guide the user forward. Product discovery works in a similar way. Instead of browsing generic pages, customers explain their situation and receive answers tied to eligibility, pricing logic, and real constraints. Balance checks, card status questions, and transaction confirmations follow naturally because the data already exists inside core systems.

Disputes and issue reporting also benefit. A conversation can collect structured details step by step, verify context, and open a ticket that already contains the information support teams need. That shortens resolution time and reduces repeated contact. In these cases, conversational AI in finance acts as a workflow layer rather than a support shortcut.

When Conversations Deliver The Most Consistent Results

The strongest results appear in repeatable interactions where clarity, speed, and structure matter more than persuasion or creativity:

- Customer onboarding and verification flows benefit because the assistant explains each requirement in context, reacts to errors immediately, and reduces abandonment caused by confusion. Instead of generic rejection messages, users receive clear guidance on what needs to be fixed and why it matters.

- Daily account and transaction inquiries scale well through conversation because answers are factual and time-sensitive. Users can ask about balances, pending payments, or card status and receive precise responses without navigating menus or waiting for an agent.

- Payment issues and dispute initiation work better when conversations collect details gradually. The system confirms transaction data, asks clarifying questions, and opens cases with structured inputs that shorten investigation cycles.

- Internal staff support and knowledge access often delivers the highest operational impact. Agents use conversational tools to check procedures, confirm product rules, and retrieve policy details while speaking with customers, without switching systems.

- Compliance-aware guidance during live interactions helps reduce risk. Assistants can surface required disclosures, flag missing steps, and log actions automatically, which is why conversational AI for banking is increasingly used behind the scenes, not just in customer chat.

This combination of visible and internal use cases explains why conversational systems continue to expand inside financial organizations.

Insurance and Lending: Different Risks, Same Conversational Layer

Once conversational systems prove reliable in core banking, they tend to spread into nearby areas. Insurance and lending are the obvious next steps. These products deal with uncertainty, deadlines, and decisions people rarely make lightly. That is why conversational AI in finance feels natural here. It allows users to ask questions at the moment confusion appears, not days later through a ticket.

Insurance conversations usually start with interpretation. Policies are long, technical, and easy to misunderstand. A conversational interface lets customers ask direct questions about coverage, exclusions, or deductibles and receive answers linked to their specific contract. Claim handling follows the same pattern. Users care about progress more than speed. Knowing whether a document was received or a review is still ongoing often removes the urge to call support. Short, clear updates lower anxiety and reduce repeated contact.

Lending focuses on readiness. Pre-qualification conversations explain eligibility without forcing users into a full application. This matters for people who hesitate because they are unsure where they stand. Document collection also becomes smoother when the system explains why a file is needed and what alternatives might work. These exchanges feel less formal and more forgiving than rigid forms.

Timing plays a quiet but critical role. Reminders sent through conversation feel informative rather than demanding. A short prompt about a missing document or upcoming deadline often keeps a process alive without pressure.

Many of these patterns borrow directly from conversational AI for banks, then adapt to different risk models and regulations. The structure stays familiar. Conversations work best when stakes are high, time matters, and guidance reduces hesitation.

What Companies and Clients Actually Gain

When conversational systems are introduced into financial products, the impact shows up quickly in small, measurable ways. The changes are rarely dramatic on day one, yet they compound over time. Conversational AI in finance earns its value through daily interactions that move faster and break less often.

From the client’s perspective, the difference is felt almost immediately. People spend less time searching for the right place to ask a question and more time getting a usable answer. Conversations reduce the need to repeat the same issue across channels, which matters when a problem already feels stressful. Explanations are also better since answers pertain to a given piece of content and not a generic help site.

Client-side outcomes typically include:

- Response times measured in seconds rather than minutes, with response times shrinking as routine inquiries are resolved instantly rather than waiting in a line.

- Fewer handoffs, since the user remains in the same conversation and isn’t routed between chat, email, and phone.

- Better explanations because the system is capable of adapting the language depending on the question rather than making users decode official documents.

The benefit for businesses is that these are reflected in operational data. Fewer repetitive messages to support teams mean that the average interaction cost is lower. Signup processes are less complicated, because users do not abandon the process mid-stream with a misconception about an aspect. Chats yield structured data inputs.

Company-side outcomes often look like this:

- Lower support cost per user, driven by higher deflection rates for balance checks, status questions, and basic troubleshooting.

- Better conversion during onboarding, with completion rates rising as users receive guidance exactly when they hesitate.

- Cleaner data from structured conversations, making it easier to analyze common issues and refine processes over time.

These gains do not rely on hype. They come from consistency, clarity, and fewer wasted interactions.

Measurable Impact in Finance

Once conversational systems move beyond pilots, teams start evaluating them the same way they assess any operational tool. The focus shifts from user perception to numbers that show whether processes actually improved. What matters here is not dramatic growth, but steady gains that hold over time and across channels.

| Use case | Primary goal | Typical metrics improved | Realistic impact range |

| Onboarding assistant | Reduce drop-offs during sign-up | Onboarding completion rate, time to completion | +5–15% completion, 20–30% faster |

| Support automation | Handle routine inquiries at scale | Deflection rate, average response time | 20–40% deflection, seconds-level replies |

| Claims or dispute handling | Structure issue reporting early | Resolution time, repeat contacts | 10–25% faster resolution |

| Internal staff assistant | Speed up agent workflows | Handle time per case, knowledge lookup | 15–30% time savings |

Security, Compliance, and Why Finance Can’t Cut Corners

Security decisions in conversational systems are made at the interaction level. Authentication happens inside the dialogue itself, not before or after it. Users may confirm identity through one-time codes, device checks, or step-up verification before sensitive data is shown. Access control works the same way. Responses change based on role, so a customer, support agent, or supervisor sees only what is relevant to them.

Session handling is treated carefully. Context is stored only as long as it is needed to complete the task. Once a conversation ends or times out, sensitive details are cleared to reduce exposure, especially on shared or mobile devices.

Compliance adds another layer. Conversations that touch identity, payments, or decisions must align with KYC and AML requirements. That means logging key steps, tracking user consent, and keeping a clear record of how outcomes were reached. Explainability matters here. Teams need to understand why the system responded a certain way, not just what it said.

Human escalation remains essential. When a conversation reaches a risk threshold or uncertainty grows, control shifts to a person. This handoff is planned in advance, not improvised, which keeps both users and regulators comfortable.

Building Your Own AI-Driven Financial Service with Scrile AI

Building a financial service around conversation requires more than adding a chatbot to an interface. Financial teams need systems that respect regulation, integrate with existing infrastructure, and stay adaptable as rules change. This is where Scrile AI fits naturally. It is a custom development service designed for companies that treat conversational AI in finance as core infrastructure rather than an add-on.

Scrile AI projects are built around practical requirements that finance teams face during real deployments:

- Custom architecture that mirrors business logic, compliance rules, and approval chains, instead of forcing workflows into fixed templates or predefined conversation flows.

- Support for complex onboarding, verification, and escalation scenarios, including identity checks, document handling, and seamless handoff to human operators when risk increases.

- Full control over data storage, model behavior, and deployment environment, which matters for teams operating under strict security and regulatory expectations.

- Integration with existing banking, insurance, or fintech systems, so conversations connect directly to accounts, transactions, and internal tools rather than living in isolation.

It’s a good fit for organizations that look to add new features or new markets by leveraging existing systems without having to refactor the system every time that the requirements evolve. This is a great way to ensure that the technical debt is kept to a minimum while the product is evolving.

Teams choose Scrile AI if the person who holds the code is more important to them than how fast they can deploy. Instead, they are creating a conversational interface that they can enhance for two to three years before the competition catches up.

Conclusion

Conversational systems are no longer a surface feature. They are becoming part of how financial products operate, scale, and stay compliant. When built correctly, conversational AI in finance supports real workflows, reduces friction, and holds up under regulatory pressure. Teams that invest in custom architecture gain more than efficiency. They gain control. Those ready to build rather than bolt on should explore how Scrile AI solutions can support long-term financial innovation.