Crypto Point of Sale System: Bitcoin POS Solutions

Start accepting Bitcoin in-store with modern tools. This guide explores how a crypto point of sale system works, compares leading providers, and shows how to build your own checkout flow using Scrile Connect. Whether you’re a retailer or SaaS founder, it’s time to rethink payments.

crypto point of sale system

In cafes, boutiques, and mobile apps, something new is appearing at checkout—cryptocurrency logos sitting right next to Visa and Mastercard. Businesses of all sizes are beginning to support digital currencies, not just online, but in person. This shift is powered by a crypto point of sale system—a modern checkout setup that lets customers pay with Bitcoin, Ethereum, and other tokens as easily as tapping a card.

What started as an experiment is now becoming a competitive advantage. For some merchants, crypto is a way to cut transaction fees. For others, it’s about reaching a new customer base or supporting global payments without borders. As Bitcoin evolves from a speculative asset into a daily-use currency, tools like crypto POS systems are making real-world usage possible.

This article explores how these systems work, where they’re already being used, what the benefits and downsides are—and how you can integrate one into your own store or app.

What Is a Crypto POS and How Does It Work?

A crypto point of sale system lets you accept digital currency for real-world goods and services, just like a card terminal does—but with one key difference: no banks. Instead of processing through Visa or Mastercard, it connects directly to a blockchain wallet. The customer scans a QR code, approves the payment, and the transaction is confirmed in seconds.

For the business, it’s simple. A smartphone, tablet, or dedicated terminal displays the amount owed, either in crypto or in the local fiat equivalent. Behind the scenes, the system can convert crypto to fiat instantly (at the market rate), or keep the funds in digital currency. Most crypto POS systems support major coins like Bitcoin, Ethereum, and stablecoins such as USDT or USDC.

Not a Credit Card Reader

Legacy POS hardware runs through banks and payment networks. Crypto systems don’t. They work wallet to wallet. There’s no intermediary to decline a transaction or reverse it later. And because it’s all happening on-chain, there’s no risk of chargebacks or fraud in the same way card payments face.

You won’t find this setup only in tech hubs. Small businesses are already using crypto POS apps in all sorts of real-world places:

- Coffee shops accepting Bitcoin through QR scans at the counter

- Fashion boutiques letting tourists pay with stablecoins

- Farmers’ market stalls using mobile apps for Ethereum payments

- Salons offering crypto discounts to attract new clients

- Event booths with contactless, instant USDT transactions

With the right setup, it doesn’t take more than a minute to accept a crypto payment—and settle it into fiat if needed. For many merchants, it’s a simple way to step into the world of crypto without taking on the complexity.

Bitcoin in Retail: What’s Really Happening?

Over the past two years, Bitcoin has quietly carved out a spot at the checkout. From online stores to local cafés, more merchants are accepting it with little fanfare and fewer barriers than ever before. According to BitPay, Bitcoin usage for retail purchases grew by roughly 60% year-over-year, driven by improvements in point-of-sale apps and payment infrastructure.

Most stores use mobile-based crypto POS systems that generate a QR code, pull real-time conversion rates, and allow customers to pay directly from their digital wallets. Some brands go further, using dedicated hardware terminals or embedding crypto payment options on e-commerce product pages.

Here are some real-world examples:

- Luxury watch brands and electronics shops now let users pay with Bitcoin through services like BitPay and CoinGate. Payment confirmations typically take seconds, with automatic conversion to fiat if desired.

- Food trucks, boutique cafés, and independent sellers often use mobile apps like Coinify or NowPayments to accept BTC. Setup usually takes less than an hour and requires no external bank gateway.

- Sports stadiums and entertainment venues increasingly support Bitcoin POS systems for ticket sales and merchandise. In these high-volume settings, payment speed and processing fees matter most.

- Online stores using Shopify or WooCommerce can enable crypto point of sale plugins that automatically handle pricing, conversions, and wallet integrations.

Bitcoin isn’t replacing card payments — but it’s earning a stable spot next to them, especially where speed, borderless access, and transaction finality are priorities.

Why Businesses Are Adding Crypto Checkout

Merchants are practical. They’ll switch payment methods when the numbers work and the setup doesn’t get in the way. Crypto is starting to check both boxes.

Fees are the first obvious reason. Credit cards eat up 2.9% or more per transaction — sometimes over 4% with international payments. A crypto payment terminal using Bitcoin or stablecoins often brings that down to 0.5% or even less, depending on the network. That margin matters, especially for high-volume or low-margin operations.

Transaction time is the next win. Legacy systems need clearing. Crypto doesn’t. With Layer 2 chains like Lightning or Polygon, confirmations happen in seconds. The payment shows up, it’s done, and the business can move forward without waiting on settlement cycles.

For international customers, crypto removes borders. No need to fuss with exchange rates or card rejections. A tourist scans a QR code, pays in Bitcoin or USDT, and that’s it. The backend can auto-convert to local currency or keep it in crypto — depending on the setup.

There’s also a shift in buyer psychology. A growing segment of crypto holders aren’t just speculating. They want to use what they’ve earned. Businesses that accept crypto tap into that demand directly.

Some brands also use it as a subtle marketing edge. Supporting a bitcoin point of sale setup signals openness to new tech. For younger or tech-savvy customers, that’s a good look. It says the brand isn’t stuck in 2008 with chipped terminals and long PIN codes.

For businesses already exploring new tools, a crypto point of sale system is less a leap and more a next step. And it’s one that pays off — in both reach and savings.

But What’s the Catch? Risks and Drawbacks

No payment system is perfect — and crypto brings its own set of quirks. Business owners need to weigh the upside against the operational details that come with running a crypto point of sale system.

Volatility is still a real concern. Bitcoin or other coins can swing a few percent in a single hour. If there’s even a slight delay in confirmation, the value received might not match what was on the price tag. Instant conversion to fiat solves this, but not every provider offers it — and not every merchant wants it.

Then come the legal questions. Depending on where you operate, accepting crypto might require KYC procedures, tax reporting, or AML compliance. It’s not always a legal gray area — but it does vary widely across regions.

Some businesses assume it “just works,” but poor integration can lead to failed transactions or delayed settlements. A QR code alone isn’t enough. Without a properly built crypto POS system, confirmations may lag, receipts may not print, and support becomes a nightmare.

There’s also a decision to make: Do you want to hold crypto or convert it instantly? Holding opens the door to gains — or losses. Auto-conversion offers stability, but usually through a third party that takes control of the funds briefly.

And last, the privacy question: Crypto transactions are public on-chain. That transparency can be a feature or a flaw, depending on how much customer data you want exposed.

A well-chosen setup smooths out most of these bumps. But ignoring them? That’s where trouble starts.

Popular Crypto POS Providers Compared

There’s no shortage of crypto point of sale system options, but the right fit depends on how and where you sell. Below is a quick breakdown of five well-known crypto POS providers.

| Provider | Best For | Fee Structure | Fiat Conversion | Hardware Support |

| BitPay | U.S. retailers, hospitality, events | 1% flat per transaction | Yes | Yes (POS terminals, card readers) |

| NOWPayments | Online stores, SaaS, e-commerce | ~0.5% base fee, discounts at volume | Optional (auto or manual) | No |

| CoinPayments | Global small/medium businesses | 0.5%–1%, varies by coin | Partial (some currencies) | Optional (via integrations) |

| B2BinPay | High-volume merchants, exchanges | Custom quote-based | Yes | Yes (integrates with POS systems) |

| Binance Pay | Crypto-native businesses | Free within Binance ecosystem | No | No |

Some merchants prioritize simplicity and low fees. Others need fiat support or on-premise hardware. Each of these tools offers a different trade-off — from global reach to developer customization. Always check terms and payout schedules before integrating.

Adding Crypto POS Logic to Your Own Platform

Some businesses don’t want to rely on pre-built checkouts or hosted pages. They want a direct connection. With the right setup, a crypto point of sale system can be fully embedded into your platform, app, or storefront. That means no redirects, no third-party branding — just one seamless experience for the end user.

APIs and SDKs make this possible. They give developers the tools to:

- Create unique checkout flows that match the business model

- Route payments to different wallets based on product, location, or currency

- Trigger receipts, confirmations, or accounting entries the moment a block is confirmed

- Link the crypto transaction to fiat settlement tools for optional conversions

Whether you’re working with Bitcoin, stablecoins, or a mix of assets, a full integration makes things feel native. And when payments feel native, more users actually complete them.

For businesses that want to launch their own branded tools — maybe a terminal app, kiosk interface, or even a POS for franchise partners — some providers allow full crypto point of sale functionality to be white-labeled. You get the backend engine, but the look, feel, and behavior are completely yours.

This isn’t just about aesthetics. Full control means:

- You set the fee structure

- You choose which coins to accept

- You control how user data is handled

- You define settlement logic — crypto, fiat, or a blend

In short, it’s your system, on your terms. The only requirement: a partner that builds it with you.

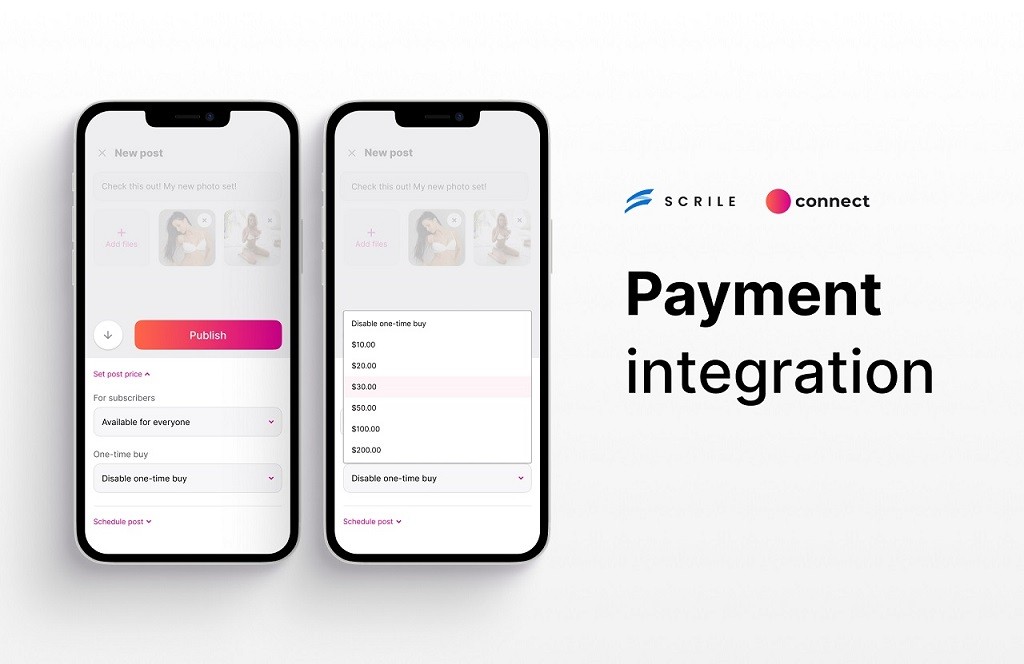

Scrile Connect: Build Your Own POS Flow

When you need more than a plug-and-play checkout, Scrile Connect offers something different. It’s not a platform. It’s a hands-on development service built to match your vision. Whether you’re building a crypto-enabled kiosk, a membership app, or a retail system that accepts tokens at the register, their team can help you implement a crypto point of sale system that fits your product, not the other way around.

You define the rules:

- Which wallets users can pay with

- Which coins or tokens are accepted

- How fees are handled — flat, percentage, or dynamic

- How payment data connects to your invoicing, notifications, or accounting

- What the interface looks like on both merchant and customer sides

Everything is white-label, meaning your users only see your brand. There’s no Scrile logo, no third-party redirects, and no commission on your transactions.

You can also layer in additional logic. Add subscriptions or recurring invoices. Sync payments with bookings, memberships, or access control. Scrile Connect can build around your current stack — no need to rebuild from scratch.

It’s flexible by design. You can integrate with popular providers like BitPay, NOWPayments, CoinPayments, Binance Pay, or go wallet-to-wallet directly. The architecture adapts to whatever crypto flow makes sense for your business model.

If you want your own system instead of renting someone else’s, this is the way to go. Scrile Connect builds it with you, on your terms.

Conclusion

The idea of paying with Bitcoin used to sound futuristic. Today, it’s just one more option at checkout. From small cafes to global retailers, the crypto point of sale system is moving into the real world. It’s not about hype anymore. It’s about letting customers choose how they pay — and meeting them where they are.

Fees are lower than credit cards in many cases. The setup is fast. And for customers holding crypto, it’s a way to spend without conversions or banking middlemen. Merchants get direct payments, clear settlement rules, and more flexibility.

Off-the-shelf POS apps can get you started, but they rarely adapt to your specific needs. If you want a branded experience with your own rules, currencies, and flow — you’ll need something custom.

Reach out to the Scrile Connect team to build a crypto checkout system tailored to your product. We’ll help you launch exactly what you need: secure, commission-free, and fully under your control.

Build your own crypto POS system. Scrile Connect is ready to help.

FAQ

What is POS in crypto?

The term “POS” in crypto can mean two very different things, depending on context. In this article, crypto POS stands for Point of Sale — a system that lets businesses accept cryptocurrency payments from customers, just like a card terminal does with Visa or Mastercard. These systems use QR codes, wallet integrations, and sometimes even physical terminals to enable crypto transactions in-store or online.

However, in blockchain infrastructure, “PoS” often refers to Proof of Stake — a consensus mechanism used by blockchains like Ethereum and Solana. It has nothing to do with retail payments. Don’t confuse the two.

Is Bitcoin Cash PoW or PoS?

Bitcoin Cash, like Bitcoin, uses Proof of Work (PoW). That means miners compete to validate transactions by solving complex math problems — the same way Bitcoin itself works. While this matters for blockchain security and how coins are minted, it doesn’t affect how a merchant accepts Bitcoin Cash at the register. For payments, it functions just like any other coin.

What is an example of a PoS crypto?

Popular Proof of Stake (PoS) coins include Ethereum, Cardano, and Solana. People can “stake” these tokens to help validate the network and earn rewards. But if you’re a business owner, that part’s not your concern. For payment systems, the most widely accepted cryptos remain Bitcoin (BTC) and stablecoins like USDT — regardless of whether they use PoW or PoS under the hood.