Crypto Subscription & Recurring Payments Explained

Crypto subscriptions let businesses accept recurring payments through wallets instead of cards. Learn how crypto subscription models work, their use cases, risks, and how to launch recurring payments with Scrile Connect.

crypto subscription

More businesses are testing crypto subscription models for a simple reason: card payments don’t work everywhere, and they don’t work for everyone. Banks block regions. Cards expire. Chargebacks wipe out revenue overnight. For companies selling access over time, that friction adds up fast.

Crypto subscriptions take a different route. A user connects a wallet once and authorizes recurring payments directly. No bank approval. No surprise reversals. Memberships, paid communities, and ongoing services can run on clear rules instead of intermediaries. That’s appealing to global audiences, developers, creators, and Web3 users who already live in crypto.

This doesn’t mean crypto subscriptions are effortless. Automation needs careful design. Pricing must account for volatility. Some users still expect card-level simplicity. This article looks at where crypto subscriptions work well, where they struggle, and how businesses actually implement them today. The goal is practical understanding, not buzzwords.

What a Crypto Subscription Actually Is

A crypto subscription works differently from card billing, even if the result looks similar on the surface. With a card, the user gives permission once and the payment processor pulls money on a schedule. Banks sit in the middle. They approve, block, reverse, or delay transactions. Crypto removes that layer, which changes how subscriptions must be built.

At the core is wallet authorization. Instead of saving card details, the user connects a wallet and approves a rule. That rule defines how much can be charged, how often, and under what conditions. From that point on, payments can repeat automatically as long as the wallet has funds and the authorization remains valid.

There are two common technical approaches:

- On-chain logic, where a smart contract controls timing and execution. This is transparent and verifiable, but costs more in fees and requires careful contract design.

- Off-chain scheduling, where a backend system triggers payments using prior wallet approval. This is cheaper and more flexible, but shifts responsibility to the service provider.

This is where the difference between a one-time crypto payment and recurring crypto payments becomes obvious. One-time payments are simple. Send funds. Confirm transaction. Done. Subscriptions require memory, timing, retries, and failure handling. Missed payments, low balances, and cancellations all need logic.

Real-world examples already exist. Crypto.com allows merchants to charge users on a recurring basis through wallet approvals. Kraken runs Kraken+, a subscription product renewed automatically. Binance uses auto-subscribe features for earning products, showing how recurring logic works even when assets stay inside an account.

Automation is the hard part because crypto does not forgive mistakes. A poorly designed system fails silently or breaks trust fast. Subscriptions only work when rules are clear, transparent, and predictable for both sides.

Where Crypto Subscriptions Are Used Today

The crypto subscription model shows up first where traditional billing creates friction. These are businesses that sell access over time, serve global users, or operate in niches where banks slow things down. Instead of treating crypto as an experiment, they use it as infrastructure.

Several practical scenarios stand out:

- Content creators and gated communities

Creators offering premium articles, videos, private chats, or Discord-style communities use crypto subscriptions to manage access. A wallet connects once, and recurring payments unlock content automatically. This works well for global audiences and for creators who want predictable income without relying on platforms that can demonetize overnight. - SaaS products and developer tools

Smaller SaaS teams increasingly accept subscriptions in crypto, especially when serving developers or Web3-native users. Access to dashboards, APIs, analytics panels, or automation tools can be tied directly to subscription status. A crypto subscription service fits naturally here because users already manage wallets and expect programmatic access. - Donations and supporter memberships

Nonprofits, open-source projects, and independent creators use subscriptions for recurring support rather than one-off donations. Supporters opt into monthly contributions, often receiving updates, early access, or private streams in return. This model turns irregular donations into steady funding. - NFT and Web3 communities

Some communities use subscriptions to grant ongoing perks instead of one-time NFT purchases. Access to private channels, drops, events, or voting rights can depend on active payments rather than ownership alone.

One familiar early example is Bitcoin membership models, where users paid monthly in BTC to access forums, newsletters, or private research groups long before modern subscription tools existed.

Across all these cases, the logic is the same. The crypto subscription controls access. When payment stops, access updates automatically. That clarity is what makes subscriptions work in crypto, even when the use

Why Businesses Choose Crypto for Subscriptions

Companies rarely switch to crypto subscriptions because it sounds innovative. They do it after running into limits that card payments can’t solve cleanly. These limits show up fast once a product reaches users outside a single country or payment ecosystem.

Global reach is usually the first trigger. Card billing depends on banks, local rules, and issuer approvals. Entire regions get blocked without warning. A crypto wallet doesn’t care where the user lives. If the wallet works, the subscription works. For businesses selling digital access, that consistency matters more than speed or branding.

Control is another reason. Card subscriptions sit inside payment processors. Those processors can freeze accounts, delay payouts, or shut billing down entirely. Crypto subscriptions move the logic closer to the product itself. Payments follow rules the user approved, not policies that can change overnight.

User expectations also play a role. In crypto-native environments, people already manage wallets, permissions, and balances daily. Subscriptions feel like an extension of existing behavior, not a new hurdle.

In practice, teams point to a few concrete benefits once crypto is in place:

- Access without regional friction

Users don’t need a supported card, a compatible bank, or a billing address. A wallet is enough, which opens markets that cards quietly exclude. - Reduced payment disputes

There are no classic chargebacks. That lowers risk for memberships, SaaS access, and recurring services where reversals can cause abuse. - Clear payment rules

Subscription terms are explicit. Users see what they approve and when payments happen, which reduces confusion and support load. - Alignment with Web3 users

Developers, DAO members, and NFT communities already expect wallet-based interactions.

Limits, Risks, and Security Considerations

Crypto subscriptions work well when they are designed carefully. Most problems appear when teams assume they behave like card billing and skip the details. This is where things usually get complicated.

Price volatility is the first challenge. Crypto assets fluctuate. It is therefore possible for a subscription with a fixed token price to become distant from the original value through time. This is often addressed through the use of stablecoins or recalculations for every subscription period for a business.Both approaches work, but each requires clear rules and user communication.

Another thing is the wallet balance dependency. When it involves cards, the payment will fail silently and then try again. When it involves cryptocurrencies, the wallet has to have enough funds for the renewal at the precise moment. Otherwise, the payment process will fail if the wallet has insufficient funds.

However, the UX itself also has issues. Approvals in the wallet, confirmations, and fees all create friction. If the path to getting a subscription is confusing and unpredictable, users will abandon the process. For subscriptions to be a success, the process has to be reliable and understandable to non-technical users.

From a technical standpoint, risks usually fall into a few areas:

- Smart contract logic errors. Poorly written contracts can lock funds, misfire renewals, or expose exploits. Contracts handling subscriptions must be minimal, audited, and upgrade-aware.

- Custody and key management. Whether funds are user-held or temporarily custodied, private keys and permissions must be handled securely. Mistakes here are irreversible.

- Backend coordination. Access control, billing state, and payment status must stay in sync. If the backend loses track of subscription state, users either lose access unfairly or keep it without paying.

How Crypto Subscriptions Are Implemented Technically

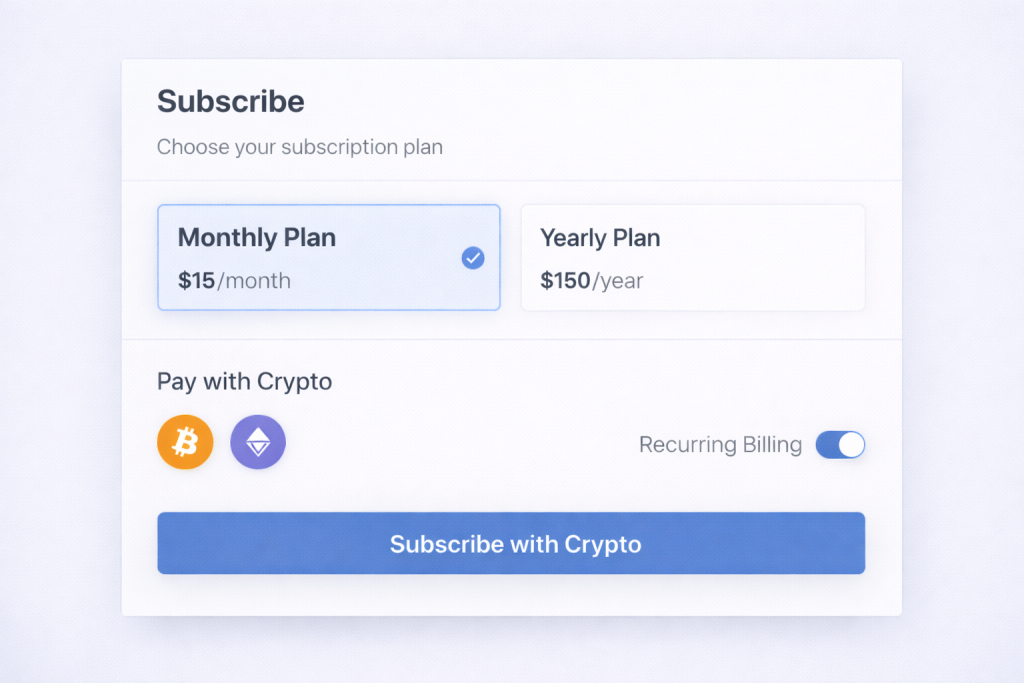

At a technical level, crypto subscriptions are built around permission rather than stored payment details. Instead of saving a card, the user approves a wallet action that allows recurring charges under specific conditions. This approval defines limits, frequency, and scope. Once granted, the system can attempt renewals automatically without asking the user to sign every transaction again.

There are two main implementation paths. Some teams rely on on-chain smart contracts that execute renewals based on predefined logic. This approach is transparent and verifiable, but it comes with higher transaction costs and less flexibility when changes are needed. Other teams use off-chain schedulers. In this case, the backend tracks time, checks wallet balances, and triggers payments using previously approved permissions. This reduces fees and allows faster updates, but it places more responsibility on backend reliability.

Asset choice matters as well. Subscriptions priced in volatile assets like Bitcoin or Ethereum expose both sides to price swings. Many businesses avoid this by using stablecoins pegged to fiat value. Stablecoins simplify pricing, refunds, and accounting, while still keeping the payment crypto-native. Volatile assets are usually reserved for niche audiences that explicitly prefer them.

Renewals, failures, and cancellations require careful coordination. When a renewal fails due to insufficient balance or network issues, the system must decide whether to retry, pause access, or notify the user. Cancellations should immediately update access rights without touching funds already settled. None of this logic exists by default in crypto. It must be designed deliberately.

The difference between traditional and crypto subscriptions becomes clearer when compared side by side:

| Aspect | Traditional subscriptions | Crypto subscriptions |

| Authorization | Stored card details | Wallet-based approval |

| Renewals | Processor-managed | Contract or backend logic |

| Failures | Automatic retries | Custom retry rules |

| Chargebacks | Possible | Not applicable |

| Global access | Region-dependent | Wallet-based |

Launching Crypto Subscriptions with Scrile Connect

Scrile Connect is not a ready-made billing platform and not a payment gateway you plug in and forget. It is a custom development service built for teams that want to design their own crypto subscription logic from the ground up. That difference matters once subscriptions move beyond simple experiments and become part of core revenue.

Instead of forcing businesses into predefined flows, Scrile Connect builds subscription systems around real product needs. This approach works especially well when recurring payments must interact with access rules, user roles, or content delivery.

At the foundation, Scrile Connect enables several critical components:

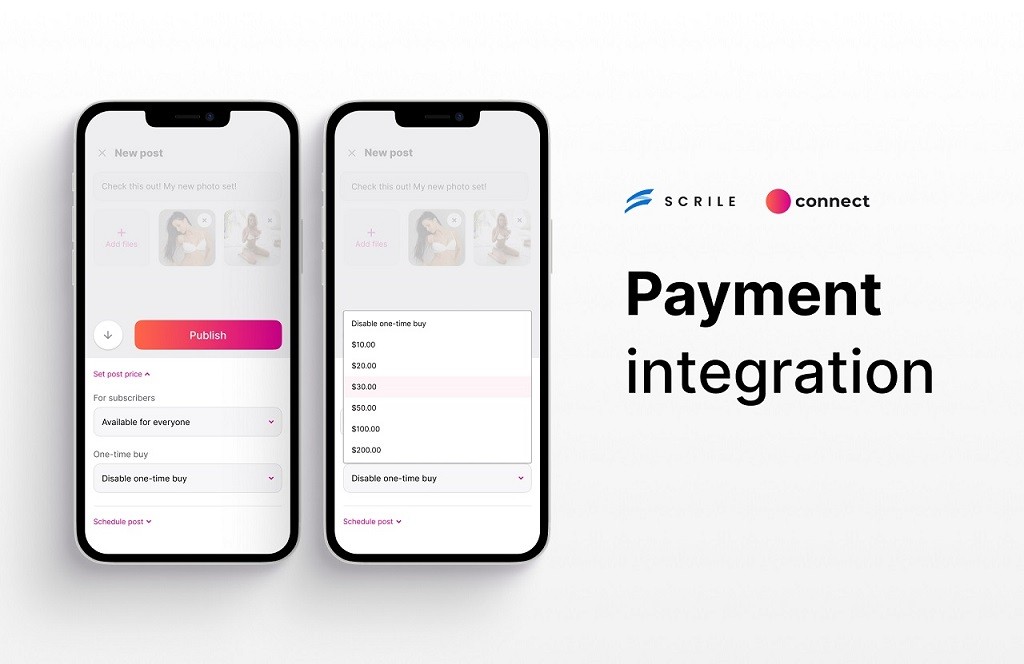

- Custom subscription logic. Billing rules are defined at the product level. Renewal timing, grace periods, retry logic, and cancellation behavior are designed explicitly instead of inherited from a third-party processor.

- Wallet and payment integration. Subscriptions can work with selected blockchains, wallets, and assets, including stablecoins or volatile tokens. Approval flows are shaped for clarity, not just technical correctness.

- User accounts and access control. Subscription status directly controls access. When a payment renews, access stays open. When it fails or ends, access updates immediately across content, features, or services.

- Flexible pricing models. Monthly access, tiered memberships, usage-based plans, or supporter-style subscriptions can coexist in one system.

Why Custom Development Changes the Outcome

Scalability is where custom development shows its value. Off-the-shelf tools often break once subscriptions grow, pricing evolves, or compliance rules change. With Scrile Connect, logic lives inside your product, not outside it. That makes updates predictable instead of disruptive.

This approach fits many real scenarios. Content platforms use subscriptions to unlock premium articles, videos, or private communities. SaaS tools gate dashboards, APIs, or analytics behind recurring access. Communities and DAOs manage member-only channels or voting rights. Donation-based projects turn irregular support into recurring funding.

In each case, Scrile Connect acts as the technical backbone, allowing businesses to run a crypto subscription system that adapts as the product grows, rather than limiting it.

Conclusion

Crypto subscriptions make sense when businesses need flexibility, ownership, and global access without depending on banks or rigid payment processors. They fit digital products, memberships, SaaS tools, and communities where access control matters more than frictionless cards. They are less effective for audiences that expect traditional billing or fixed pricing without volatility. The real advantage is control. When subscription logic belongs to the business, growth stays predictable. To build that foundation properly, Explore Scrile Connect solutions.

FAQ

What is a crypto subscription?

A crypto subscription is a recurring payment model where users pay from a crypto wallet instead of a credit or debit card. The user approves a recurring charge once, and the system renews access automatically based on that approval. Functionally, it works like a card subscription, but payment execution and control are handled through wallets and blockchain-based logic.

What is a subscription in Binance?

In Binance, subscriptions appear in products like Auto-Subscribe and Simple Earn. These features allow users to automatically reinvest or renew positions using idle digital assets. While this is not a merchant subscription system, it demonstrates how recurring logic works inside crypto platforms using predefined rules.

Which crypto is best for daily earning?

Bitcoin and Ethereum are commonly used because they are liquid, widely supported, and trusted. However, their price volatility makes them risky for daily earning strategies. Most businesses prefer stablecoins for subscriptions, while volatile assets are used only when users understand the risk.