Recurring Crypto Payments: Web3 Payment Solutions

Recurring crypto payments are becoming a real alternative to card-based subscriptions. This article explains how automated blockchain billing works, why businesses use it, and what tools power Web3 payment systems. You’ll also learn how Scrile can build a custom crypto billing solution for your website.

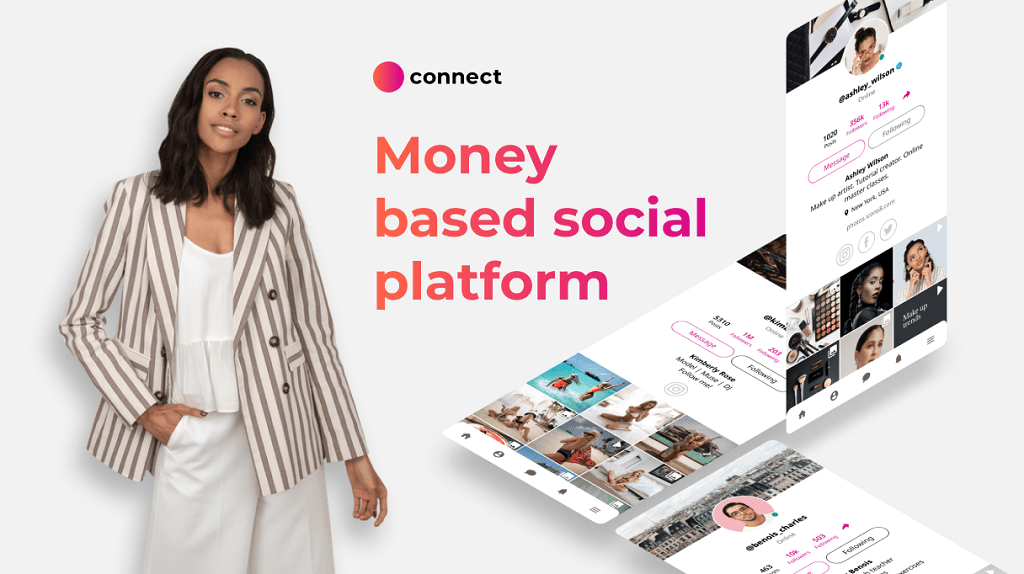

recurring crypto payments

People barely notice how many subscriptions run their daily routine anymore. A streaming platform for the commute, a design tool for work, cloud storage, a few creator memberships, maybe a fitness app. Most of it renews in the background. Cards get charged, invoices pile up, and the cycle moves on without much thought. This familiar system is starting to shift as a new option enters the picture. More companies are experimenting with recurring crypto payments, and the idea is moving from niche curiosity to something practical.

Crypto wallets can approve automated transactions, so scheduled billing no longer depends on card networks or banks. A smart contract can handle a monthly charge, and the system runs as long as the user keeps enough balance. No expired cards, no blocked transactions, no regional restrictions. This appeals to businesses that reach global audiences and want fewer interruptions in their subscription flow.

The concept is spreading through platforms that already support automated purchases. Developers see patterns that look familiar but run on different rails. The mechanics are simple once you break them down, and the benefits become clear with real examples. This article explains what recurring crypto payments are, how they work, the Web3 models behind them, and how you can integrate the same capabilities into your own website with a custom solution built by Scrile company.

What Are Recurring Crypto Payments?

Recurring crypto payments are scheduled transfers made in cryptocurrency. A user approves the charge through their wallet once, and that permission allows the system to renew the payment on a set cycle. It works much like the subscriptions people already use for apps or entertainment, only the billing rail changes. A wallet signature replaces the chain of banks and card processors.

Conventional billing fails in familiar ways. A card expires. A bank blocks an international transaction. Some customers do not have access to cards at all. Wallet approval avoids these weak points. After the user grants permission, the system attempts each renewal automatically. It succeeds when the wallet has enough balance and pauses when it doesn’t. Gas fees still matter, and each network has its own tempo, but once configured, the routine stays consistent. That reliability is one reason recurring crypto payments appeal to companies with users spread across countries.

Businesses apply this model in many situations. Software teams renew account access. Creators maintain paid communities. Games update season passes. NFT utilities refresh perks on a monthly cycle. Any product that depends on ongoing access can use this structure.

The process usually follows a simple chain:

- The wallet asks the user to approve recurring charges.

- The user chooses the token and billing interval.

- The system stores that approval for future cycles.

- The contract checks the balance and gas conditions at renewal time.

- If everything aligns, the payment goes through. If not, the system waits instead of failing silently.

Recurring crypto payments rely on these small steps working together, creating a subscription flow that operates without banks or card networks.

How Automatic Billing Works on a Blockchain

Smart contracts define the entire routine. They track time, check balances, and trigger payments without involving banks or card processors. This automation removes many friction points that plague traditional subscriptions. Teams building global products often look at recurring crypto payments because the billing engine doesn’t change based on the customer’s country or their card issuer. The rules stay consistent. The schedule stays predictable. The system runs as long as the chain itself continues to operate.

Why Recurring Crypto Payments Matter for Businesses

The subscription economy keeps expanding. Analysts expect the global market to cross 1.5 trillion dollars by 2030, fueled by software bundles, creator memberships, cross-platform gaming passes, and a long list of digital services that rely on predictable monthly revenue. Businesses want payment systems that match this momentum. This is where recurring crypto payments start to fit into real commercial plans instead of staying on the edges of Web3 experiments.

The appeal is practical. Crypto moves across borders without asking banks for permission. A customer in one region can renew their subscription in seconds without currency conversions. Chargebacks disappear because transactions are final. Fees shift from card processors to the chain itself, which often results in lower operating costs. When a company chooses stablecoins like USDT or USDC, the monthly price doesn’t swing. Many companies serving emerging markets look at crypto because large portions of their audience don’t have reliable card access but do have wallets. This is one reason Web3 payment options are appearing in more business conversations.

A few advantages stand out once you examine how businesses actually use subscription billing:

- Reliable global access: a customer only needs a compatible wallet. They don’t need a credit card, a bank account with international clearance, or an address that card processors recognize.

- Fewer failed renewals: wallet-based approvals bypass many predictable issues such as expired cards, fraud filters, and regional transaction blocks. The subscription keeps running as long as the customer maintains balance.

- Predictable revenue: companies using stablecoins know the amount they receive each cycle. It simplifies revenue forecasting and reduces uncertainty across markets.

- Better margins: moving billing logic to on-chain infrastructure often lowers payment overhead. Card networks layer fees and conditions, while blockchain transactions follow transparent rules.

Web3 Payment Infrastructure and Subscription Tools

Automated billing becomes possible in Web3 because smart contracts can execute rules without asking a bank or processor to approve every renewal. Once a user signs a wallet permission, the contract stores that authorization and uses it at each interval. The logic is mechanical: check the balance, confirm network conditions, execute the transaction. This structure is different from traditional billing but grounded in the same goal, which is to create a steady flow of payments that a business can rely on. Many teams exploring recurring crypto payments find themselves drawn to this model because it replaces a fragile chain of third-party approvals with a predictable set of blockchain rules.

A few technologies make this possible. DeFi introduced the idea of automated transactions long before subscriptions entered the conversation. Wallet approvals allowed users to grant recurring permissions in a controlled way. Gas fees forced developers to design smarter cycles, since each renewal has a cost. Cross-chain tooling gave merchants more choices, from low-fee networks to more established chains. These elements form the backbone of modern Web3 payment systems.

To build something businesses can trust, several layers have to work together:

- Wallet approval mechanisms handle the first handshake with the user, and they determine how much freedom the contract has to pull funds in the future.

- Recurring charge logic sets the timing structure, evaluates the user’s balance, and adapts to changing gas prices so renewals don’t fail unexpectedly.

- Off-chain event tracking keeps records of every renewal, which supports analytics, invoices, and customer notifications.

- Merchant dashboards show subscription status in real time and help teams adjust pricing, intervals, and supported tokens.

- Token selection allows companies to support BTC, ETH, USDT, USDC, or other assets, depending on volatility tolerance and user preference.

What a Real Web3 Subscription Stack Looks Like

A complete stack usually contains smart contracts, payment processors, billing dashboards, and integration layers that connect everything to the company’s website or app. Monitoring tools watch for low balances or interrupted renewals. API routes move data between the chain and the merchant’s internal systems. These parts turn Web3 payments into something companies can operate at scale, and they form the foundation of modern Web3 payment solutions. As more teams explore global subscription models, recurring crypto payments become a practical option rather than a technical experiment.

Limitations, Risks, and Security Factors

Businesses exploring recurring crypto payments gain more control over global billing, but they also accept a set of limitations that differ from card-based systems. Some come from how blockchains operate, others from how users handle their wallets. Gas fees shift throughout the day, so the real cost of a renewal can change without warning. A wallet might not hold enough tokens at the moment of the charge. Even users who want to stay subscribed can miss a cycle because the balance wasn’t topped up in time.

Smart contracts introduce their own responsibilities. Code needs to be audited, updated, and monitored. A flaw hidden inside a contract can create problems long after the subscription system goes live. User onboarding also demands attention. Many people still feel uneasy when a wallet asks for permission to process automatic payments. Regulations add another layer. Companies that convert crypto revenue into fiat must follow local KYC and AML rules, which can slow the withdrawal process.

Different networks create different challenges. Some chains become slow during high traffic. Some stablecoins carry better liquidity than others. These variables shape how smooth or unpredictable an automated billing cycle becomes.

Key Obstacles in Recurring Crypto Payments:

| Challenge | Cause | Impact |

| Gas Fee Volatility | Network spikes | Higher renewal cost |

| Failed Billing Cycles | Low wallet balance | Missed revenue |

| Smart Contract Issues | Poor audits or outdated code | Security risk |

| Onboarding Difficulty | Limited user knowledge | Lower conversion |

| Regulatory Pressure | KYC/AML on cash-outs | Slower payouts |

| Network Congestion | High on-chain activity | Delayed renewals |

| Stablecoin Liquidity Gaps | Token-specific market differences | Pricing complications |

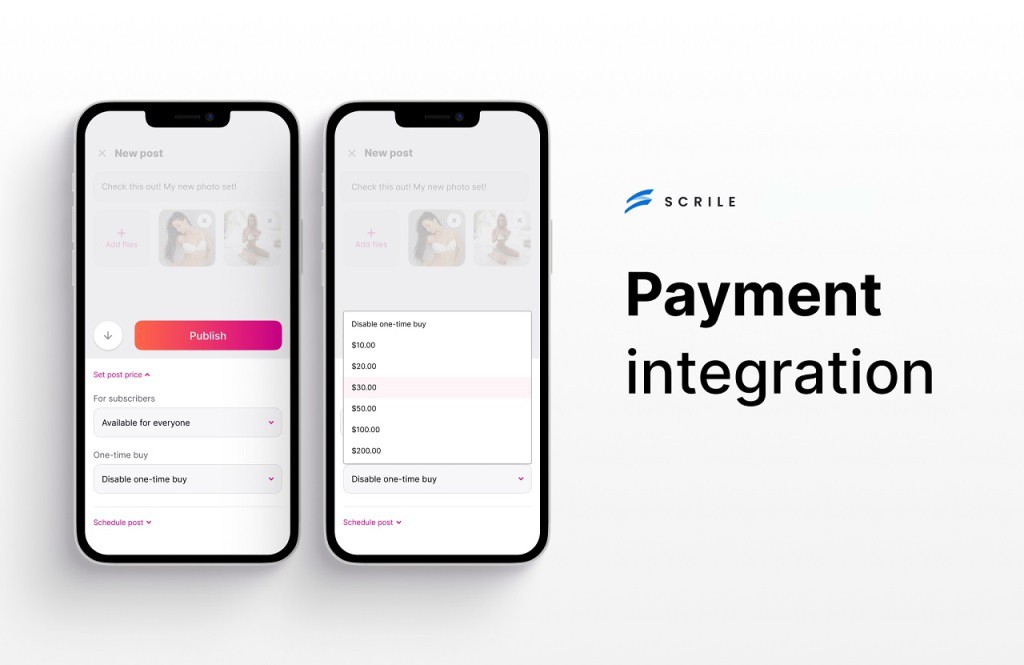

Scrile Custom Development: Integrating Crypto Billing Into Your Website

Once a company decides to support recurring crypto payments, the real work begins. Connecting wallets to billing logic is rarely simple. A business needs permission handling, renewal schedules, notifications, an admin dashboard, a way to monitor failed charges, and a smart contract that won’t break under load. Many teams try to stitch these pieces together with plugins or prebuilt gateways, but most outgrow those limits fast. Subscription systems behave differently in every industry, so a one-size template rarely holds up.

This is where Scrile custom development makes sense. A tailored setup adapts to the business rather than forcing the business to adapt to the tool. Scrile works in this space, building crypto billing systems that match the exact rules a product needs. It isn’t a SaaS platform. It’s a development partner that designs the full stack behind the subscription flow.

Scrile can build the core elements that make a Web3 billing system reliable:

- Custom crypto billing logic: renewal timing, balance checks, token selection, and gas-aware execution.

- Admin subscription dashboards: real-time status, user history, renewal reports, and manual overrides when needed.

- Smart contract engineering and audits: contracts that handle renewals safely and follow clear rules.

- Wallet onboarding flows: clear prompts, simple approval requests, and fallback options for users who are new to crypto.

- Stablecoin pipelines and multi-chain support: USDT, USDC, or other assets routed across networks that fit your cost and speed targets.

Scrile structures each build around the product’s needs. Some businesses want a simple monthly subscription. Others need tiered pricing, usage-based billing, or hybrid models that mix Web2 and Web3 logic. The Scrile’s team adapts the system to fit these requirements instead of pushing a prepackaged solution.

Conclusion

Recurring crypto payments have moved far beyond theory. They give businesses a way to reach customers without fighting card restrictions or regional barriers. The model supports global access, steady revenue, and fewer renewal failures, and it works well for companies that rely on subscriptions to grow. As more products adopt Web3 tools, automated crypto billing becomes a natural extension of how digital services operate. If your website or app needs a subscription system that works across borders, consider adding a crypto option. Contact Scrile’s team to build a custom version tailored to your rules, your market, and the experience you want your users to have.

FAQ

Is recurring investment in crypto good?

Recurring purchases help smooth out volatility because the investor buys at different price points instead of chasing peaks. It is the same idea behind recurring crypto payments, only applied to savings instead of subscriptions. Over time, this steady pattern can lower the average entry price.

Can you do recurring payments on Coinbase?

Coinbase supports recurring buys for certain assets. The user chooses the token, amount, and schedule. Some payment methods qualify and others do not, so the app shows which options are allowed.

What is a recurring buy in crypto?

A recurring buy is an automatic purchase of a chosen asset on a set schedule. The user picks how often it runs, and the system handles the rest, similar to how subscription billing renews on its own.